Curious about the world of property management and how technology is revolutionising the industry?

The benefits of implementing technology in property management are undeniable, from streamlined communication to enhanced security and improved tenant experiences.

In this article, we will delve into the responsibilities of property managers and explore the top technologies reshaping how properties are managed.

Discover how to identify your needs, choose the right technologies, and train your team to stay ahead of the curve in this tech-savvy landscape.

What is Property Management?

Property Management involves overseeing residential, commercial, or industrial properties on behalf of the owner. It encompasses various tasks such as rent collection, property maintenance, tenant management, and compliance with regulations and leases.

Property managers play a crucial role in maintaining the value and functionality of properties. By efficiently handling day-to-day operations, they help enhance property value and ensure tenant satisfaction. Effective property management includes conducting regular property inspections, promptly addressing maintenance issues, and fostering positive relationships with tenants.

A well-managed property attracts and retains quality tenants, leading to reduced vacancy rates and increased rental income. Property managers are responsible for financial management, budgeting, and ensuring that the property operates within legal parameters to protect the owner's investment.

What are the Responsibilities of Property Managers?

Property managers have many responsibilities, including maintenance scheduling to ensure properties are well-maintained, enhancing tenant experience by addressing their needs promptly, ensuring operational efficiency in property management processes, and implementing sustainability practices for eco-friendly operations.

They are crucial in planning and overseeing maintenance tasks such as repairs, landscaping, and cleaning to uphold the property's quality standards.

They focus on developing strategies to boost tenant satisfaction and ensure quick response times to any tenant concerns or issues that may arise.

Property managers also work on streamlining operations by optimising procedures related to rent collection, lease renewals, and vendor management.

Incorporating sustainable practices like energy-efficient upgrades and waste reduction initiatives is essential to minimise the property's environmental impact.

The Benefits of Implementing Technology in Property Management

Implementing technology in property management offers numerous benefits, including the automation of routine tasks, access to real-time data analytics for informed decision-making, improved energy efficiency through smart technologies, and enhanced operational capabilities through cloud-based solutions.

Property managers can streamline processes and optimise resource allocation by integrating cutting-edge technologies. Automation reduces manual errors and frees up time for strategic planning.

Data-driven insights enable proactive maintenance, leading to cost savings and improved tenant satisfaction. Energy-saving opportunities, such as smart thermostats and lighting, contribute to sustainability goals while lowering utility expenses.

Cloud-based digital solutions offer scalability and flexibility, simplifying access to information from anywhere with internet connectivity.

Streamlined Communication

One key benefit of technology in property management is streamlined communication. This allows property managers to remotely access information, use communication tools for efficient interactions, and provide tenants with user-friendly communication platforms.

This advancement in technology has transformed the way property managers handle communication tasks. With the ability to access data remotely, property managers can stay updated on property information from anywhere at any time. Utilising communication tools such as messaging apps and virtual meeting software streamlines workflows, enabling quick and effective collaborations among team members. Tenant communication platforms foster transparent and consistent interactions between property managers and tenants, addressing concerns promptly and ensuring a positive living experience.

Increased Efficiency

Implementing technology in property management leads to increased operational efficiency. This is achieved by automating manual processes, utilising tech-enabled solutions for streamlined workflows, and integrating innovative Proptech tools to optimise property management practices.

By leveraging technology, property managers can efficiently track maintenance requests, communicate with tenants through automated systems, and analyse data to make data-driven decisions. Automation eliminates repetitive administrative tasks, allowing managers to focus on strategic initiatives.

Tech-enabled solutions such as property management software, IoT devices, and virtual tours enhance customer experiences and enable remote property monitoring. Proptech innovations further revolutionise the sector by offering tools for predictive maintenance, energy management, and smart building systems.

Enhanced Security

Technology integration enhances property management security by deploying advanced security systems, smart locks for access control, real-time monitoring of property activities, and robust building security systems to ensure tenant safety.

These technologies are crucial in safeguarding the premises against unauthorised access and potential security threats. Smart lock technologies offer convenience and heightened protection by allowing property managers to remotely grant or revoke access to tenants or visitors. Real-time monitoring capabilities enable swift responses to suspicious activities or emergencies, ensuring a proactive approach to security management. Building security systems provide comprehensive coverage, incorporating features such as video surveillance, alarm systems, and access control mechanisms, bolstering the overall security infrastructure of the property.

Improved Tenant Experience

Implementing technology in property management improves the tenant experience by offering digital solutions for seamless interaction, efficient tenant management processes, and the integration of smart home devices to enhance convenience and comfort for tenants.

These technological advancements have revolutionised how property managers can engage with tenants, providing instant communication and feedback platforms, simplifying administrative tasks, and fostering a stronger sense of community within residential spaces. With the adoption of smart home devices, tenants can now easily control their environment, adjusting temperature settings, lighting, and security systems at their fingertips. Such innovations not only cater to the demands for modern living but also contribute to overall tenant satisfaction and loyalty.

Top Technologies Revolutionising Property Management

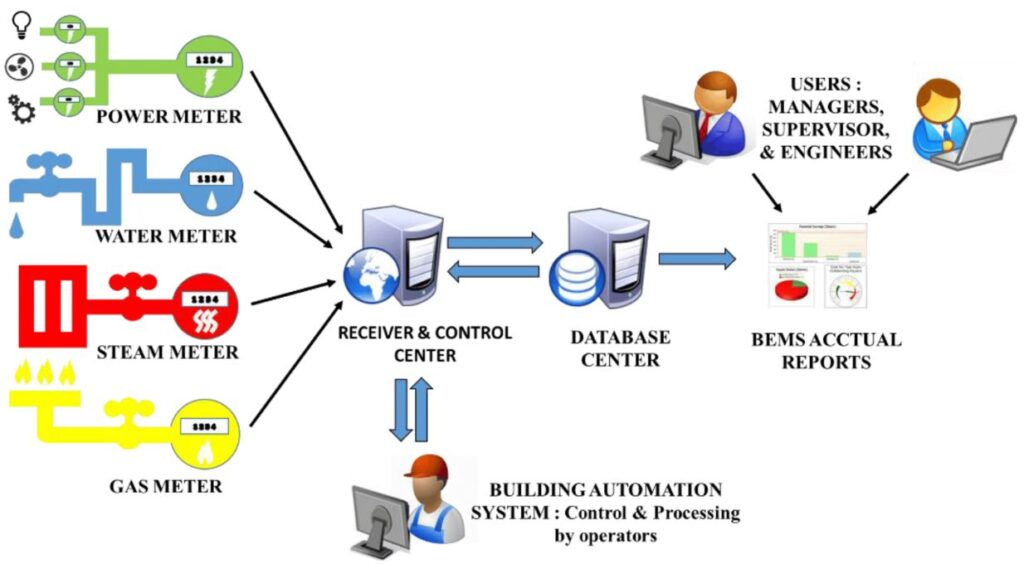

Several cutting-edge technologies are revolutionising property management, including smart buildings that integrate IoT devices for automation, artificial intelligence for data-driven insights, energy management systems for efficiency, and IoT sensors for real-time monitoring.

These technological advancements have improved operational efficiency in managing properties, allowing for proactive maintenance schedules, optimised resource allocation, and predictive analytics for informed decision-making. Smart building concepts enable centralised control of various building systems, such as HVAC and lighting, while AI applications analyse data to improve tenant experiences and streamline operations. Energy-efficient management solutions not only reduce costs but also contribute to sustainability efforts. Integrating IoT sensors is crucial in continuously monitoring property conditions, detecting potential issues promptly, and ensuring a safe and comfortable environment.

Smart Locks and Keyless Entry Systems

Smart locks and keyless entry systems are innovative technologies in property management that enhance security measures, integrate smart technologies for seamless access control, and enable remote control technology for efficient property access management.

These advanced systems provide property owners and managers with a range of benefits. By replacing traditional keys with digital access codes or smartphone apps, smart locks offer heightened security through encryption and biometric authentication. The integration of smart technology allows for automation and monitoring capabilities, such as real-time alerts and activity logs, enhancing overall property surveillance. Remote control technology further promotes convenience by enabling users to grant access remotely, track entry and exit times, and easily manage permissions from anywhere.

Online Rent Payment Platforms

Online rent payment platforms offer convenient solutions for tenants to manage payments through user-friendly portals, mobile apps for property management tasks, and cloud-based platforms that streamline rental payment processes for tenants and property managers.

These platforms provide a secure and efficient way for tenants to set up automatic payments, schedule recurring transactions, and receive payment reminders, reducing the chances of missed or late payments. Tenant portals allow renters to easily access payment history, download receipts, and communicate with property managers. Mobile apps enhance convenience by enabling tenants to make payments on-the-go and submit maintenance requests seamlessly. Cloud-based platforms ensure data is stored securely and can be accessed from anywhere, making rent management more flexible and transparent for all parties involved.

Virtual Property Tours

Virtual property tours use virtual and augmented reality technologies to offer immersive property viewing experiences. They are integrated with property inspection software for detailed analysis and remote troubleshooting capabilities for remote property assessments.

Potential buyers can experience a property realistically and interactively through VR and AR technologies without physically visiting the site. This saves time and travel costs and allows multiple virtual tours to be conducted simultaneously. Property inspection software further enhances the experience by providing detailed information on various aspects of the property, such as room dimensions, material quality, and potential maintenance needs. Remote troubleshooting solutions enable property managers to address issues quickly and efficiently, improving overall customer satisfaction.

Artificial Intelligence and Chatbots

Artificial intelligence and chatbots revolutionise property management with AI-driven decision-making processes, data-driven insights for predictive maintenance strategies, and chatbot functionalities for efficient tenant communication and issue resolution.

Integrating AI technologies in property management has significantly enhanced operational efficiency and cost-effectiveness. AI-powered algorithms analyse vast amounts of data to predict maintenance needs proactively, reducing downtime and optimising property performance. Chatbots serve as virtual assistants, offering tenants round-the-clock support for queries, maintenance requests, and lease renewals. These innovations streamline the property management workflow, increasing tenant satisfaction and facilitating quicker maintenance resolution.

Energy Management Systems

Energy management systems optimise property energy consumption through energy-efficient practices, smart thermostat integration for temperature control, and smart grid technology application for efficient energy distribution and consumption.

By implementing energy-saving initiatives, property managers can reduce operating costs and minimise their environmental impact. Smart thermostats are crucial in maintaining optimal indoor temperatures, leading to improved comfort for residents and tenants. Smart grid technology enables real-time monitoring and data analysis, allowing for better decision-making in energy usage. The integration of these technologies in property management not only enhances energy efficiency but also contributes to a more sustainable future.

How to Implement Technology in Property Management

Implementing technology in property management involves identifying specific needs and goals, researching and selecting the right technologies, training teams and tenants on tech usage, and continuously monitoring and adapting to evolving technological advancements.

Conducting a comprehensive needs assessment is crucial to understanding the current challenges and opportunities within the property management system. This step helps pinpoint areas where technology can be most beneficial, such as streamlining communication processes, automating maintenance requests, or enhancing security systems.

The next step is establishing clear technology selection criteria, considering factors like scalability, compatibility with existing systems, ease of use, and long-term cost-effectiveness.

Once the right technologies are chosen, thorough training procedures should be implemented to ensure that staff and residents effectively utilise the new tools.

Identify Your Needs and Goals

The initial step to implement technology in property management is to identify specific needs and goals, considering innovative tech-enabled solutions that can enhance operational efficiency and drive innovation in property management practices.

By clearly understanding the organisation's requirements and objectives, property managers can streamline processes, automate repetitive tasks, and leverage data analytics to make informed decisions.

Embracing cutting-edge technologies such as artificial intelligence, Internet of Things (IoT), and cloud-based platforms can revolutionise how properties are managed, leading to cost savings, improved tenant experiences, and increased profitability.

These advanced tools allow for proactive maintenance, real-time monitoring, and predictive insights, revolutionising traditional property management operations.

Research and Choose the Right Technologies

Researching and selecting the right technologies for property management involves:

- Evaluating integrated systems.

- Next-gen property management software options.

- Building automation systems that align with the property's specific requirements and objectives.

This process requires thoroughly analysing how these technologies can streamline operations, enhance tenant experience, and optimise resource usage. Integrated systems offer the advantage of seamless data flow between different applications, ensuring efficiency and centralisation. When considering next-gen software, factors like cloud-based solutions, mobile accessibility, and analytics capabilities play a crucial role in making informed decisions. Building automation systems provide smart functionalities such as energy management, security enhancements, and predictive maintenance, contributing to overall cost savings and sustainability.

Train Your Team and Tenants

Training your property management team and tenants on the effective use of technology involves guiding remote access capabilities, mobile app functionalities, and tenant management features to ensure seamless adoption and utilisation of tech-enabled solutions.

By offering comprehensive training sessions covering remote access nuances, individuals can learn to access property information securely and efficiently from anywhere.

Understanding the functionalities of mobile apps tailored for property management assists in streamlining communication and task management for team members and tenants.

Equipping property managers with effective tenant management strategies through technological tools fosters improved tenant satisfaction and engagement, enhancing operational efficiency and a positive community environment.

Monitor and Adapt to Changing Technologies

Continuous monitoring and adaptation to changing technologies in property management involve:

- Utilising property maintenance software for efficient operations.

- Embracing tech-forward management solutions.

- Implementing remote monitoring tools to stay updated on property conditions and performance.

This proactive approach is crucial for property managers to streamline their daily tasks, track maintenance schedules, and ensure optimal performance of the properties under their care. Property maintenance software offers automated maintenance reminders, real-time visibility into work orders, and cost tracking, facilitating seamless operations.

By leveraging tech-forward solutions like smart sensors and IoT devices, property managers can monitor energy usage, detect leaks, and control access remotely, enhancing property security and reducing maintenance costs. Remote monitoring applications enable managers to access property data from anywhere, allowing for prompt decision-making and swift response to maintenance issues.