Are you looking to better understand the real estate market and make informed investment decisions?

We will demystify the techniques used in real estate market analysis, exploring methods like Comparative Market Analysis (CMA) and SWOT Analysis.

Learn how to conduct a thorough market analysis by gathering data, analysing trends, and considering local economic conditions.

By the end of this article, you will have a clear picture of the factors to consider when examining the real estate market.

What Is Real Estate Market Analysis?

Real Estate Market Analysis involves studying and evaluating property market dynamics to uncover valuable insights into trends, investments, and property values. It is a crucial process for predicting market trends, assessing market performance, and determining property values through various analytical techniques.

Professionals can gain a deep understanding of the factors influencing property values and market trends by conducting a detailed Real Estate Market Analysis. This analysis helps them make informed decisions about investments, acquisitions, and selling strategies.

Utilising sophisticated analytics and valuation methods, stakeholders can accurately assess risk levels, market demand, and potential opportunities. A comprehensive analysis enables individuals to adapt to dynamic market conditions and respond strategically to fluctuations in property values, ultimately maximising returns and minimising risks in real estate transactions.

Why Is Real Estate Market Analysis Important?

Real Estate Market Analysis is crucial for stakeholders to make informed decisions regarding property investments and market trends and optimise investment strategies based on accurate data.

By delving into Real Estate Market Analysis, investors can better understand the dynamics shaping the real estate landscape. This analysis goes beyond surface-level information, offering a comprehensive view of market trends, demand-supply dynamics, and pricing patterns.

Through predictive analytics, stakeholders can anticipate future market movements, enabling them to confidently make strategic decisions. Real Estate Market Analysis provides a solid foundation for risk assessment, allowing investors to assess potential challenges and opportunities before committing to a property investment.

Leveraging these insights is instrumental in formulating successful and profitable real estate investment strategies.

What Are the Different Techniques for Real Estate Market Analysis?

Real Estate Market Analysis employs various techniques such as Comparative Market Analysis (CMA), Income Approach, Cost Approach, Investment Analysis, Demographic Analysis, Market Surveys, and SWOT Analysis to evaluate property market performance and trends.

Comparative Market Analysis (CMA) involves comparing similar properties in the same area to determine a property's value.

The Income Approach estimates a property's value based on the income it generates, commonly used for rental properties.

The Cost Approach assesses a property's value by considering its replacement cost.

Investment Analysis focuses on the potential return on investment.

Demographic Analysis examines population trends impacting property demand.

Market Surveys gather data on current real estate market conditions.

SWOT Analysis evaluates a property's strengths, weaknesses, opportunities, and threats in the market.

Comparative Market Analysis (CMA)

Comparative Market Analysis (CMA) is a fundamental technique in Real Estate Market Analysis that involves comparing similar properties in the market to determine a property's market value and potential investment performance.

By examining recent property sales data, market trends, and economic indicators, CMA provides valuable insights into the current state of the real estate market. This analysis enables investors and property managers to make informed decisions about pricing, purchasing, and managing properties. Through statistical analysis, CMA helps identify a property's fair market value, assess its competitiveness in the market, and understand its potential for appreciation or depreciation over time. This evaluation is crucial in guiding stakeholders on effectively positioning their properties for maximum returns.

Income Approach

The Income Approach is a Real Estate Market Analysis technique that assesses a property's value based on its income potential, rental revenues, and overall profitability. It is a valuable tool for investors to evaluate income-generating properties.

This method delves deep into market segmentation, identifying different categories of properties based on their income-generating capabilities. Investors can pinpoint lucrative investment opportunities within specific segments by analysing market trends and demand drivers. The Income Approach aids in formulating effective investment strategies by focusing on maximising income streams and optimising property performance. It also plays a crucial role in evaluating property portfolios, enabling investors to diversify their investments and mitigate risks by spreading assets across various income-generating properties.

Cost Approach

The Cost Approach is a Real Estate Market Analysis technique that determines a property's value based on its reproduction or replacement cost, considering economic factors, market sentiment, and risk assessment to provide insights into property pricing and market trends.

By utilising the Cost Approach, real estate professionals can evaluate a property's value by estimating the cost to rebuild or replicate it, factoring in aspects such as construction costs, depreciation, and land value. This method helps assess market challenges by analysing how changes in construction costs or market drivers can impact property values. It also aids in identifying potential risks associated with overpricing or underpricing properties in a volatile market environment, allowing for a more comprehensive view of the real estate landscape.

Investment Analysis

Investment Analysis is a Real Estate Market Analysis technique that focuses on assessing the potential return on investment, market demand, property prices, and market conditions to guide investors in making informed decisions regarding property transactions and acquisitions.

By delving into market insights and utilising data visualisation tools, investors can understand property trends and competitive forces in the property market. This analysis plays a crucial role in determining the desirability of a specific property, evaluating overall market competitiveness, and anticipating potential shifts in property prices.

A thorough Investment Analysis considers various factors such as economic indicators, demographic trends, and regulatory conditions to provide a holistic view for investors seeking to maximise their returns and navigate the dynamic landscape of real estate investment.

Demographic Analysis

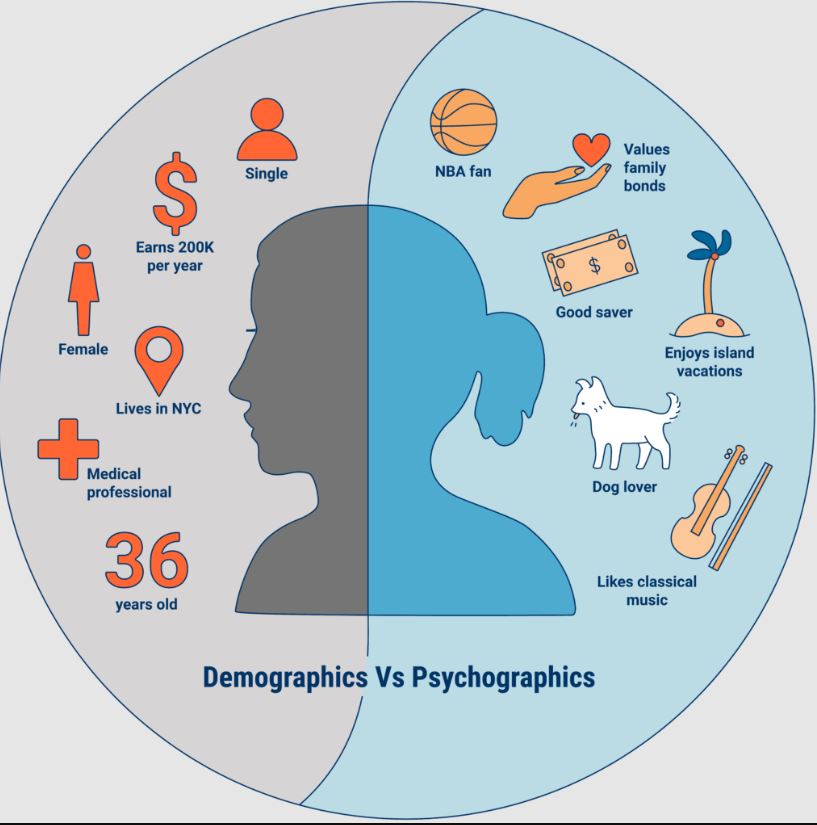

Demographic Analysis is a Real Estate Market Analysis technique that examines population trends, preferences, and behaviours to forecast market fluctuations, project future market conditions, and identify target market segments for property listings and developments.

By delving into demographic data, real estate professionals can gain valuable insights into the composition of potential buyers or renters, enabling them to tailor their marketing strategies accordingly. Through market analysis tools, such as geographic information systems (GIS) and demographic mapping software, analysts can discern patterns in age, income levels, family size, and lifestyle preferences within specific neighbourhoods or regions. Understanding these metrics is crucial in accurately predicting market trends, determining demand for certain properties, and devising successful investment strategies in the ever-evolving real estate market.

Market Surveys

Market Surveys in Real Estate Market Analysis involve collecting data through surveys, interviews, and research to identify market patterns and property trends, make predictions, interpret data, and provide insights into property ownership dynamics and market reports.

This process plays a crucial role in understanding market dynamics by analysing the gathered data to uncover trends influencing property values and ownership decisions. By delving into survey findings, analysts can extract valuable insights, such as emerging buyer preferences, demand shifts for certain property types, and indicators for future market performance. These insights aid in making informed decisions regarding investments, developments, and overall strategies within the real estate sector.

SWOT Analysis

SWOT Analysis is a strategic Real Estate Market Analysis tool that evaluates the strengths, weaknesses, opportunities, and threats in the property market. It provides a comprehensive assessment of market demand, pricing strategies, competitive landscape, and risk factors.

This technique aids real estate professionals in identifying key areas where they can capitalise on market opportunities, mitigate risks, adjust pricing strategies based on demand fluctuations, and stay ahead of competitors.

By analysing internal strengths and weaknesses alongside external factors like market trends and regulatory changes, stakeholders can make informed decisions to enhance property value and position themselves strategically in the market.

Understanding these elements is crucial for successful market analysis and business strategy in the dynamic real estate sector.

How to Perform a Real Estate Market Analysis?

Performing a Real Estate Market Analysis involves gathering relevant data, analysing market trends, conducting comprehensive property evaluations, and considering local economic factors to gain valuable insights for informed decision-making.

- To start the process, one must collect data on recent property sales, rental rates, and property listings in the target market area. This data forms the foundation for trend analysis which involves identifying patterns and forecasting future market behaviour using predictive analytics.

- Once trends are identified, conducting property evaluations comes next, where factors such as property condition, location, and amenities are considered for accurate property valuation. Economic considerations are crucial in analysing how interest rates, employment rates, and infrastructure projects impact market dynamics.

Gather Data

This data collection process involves gathering information on various economic indicators such as interest rates, GDP growth, employment rates, and consumer confidence levels, which are crucial in shaping the real estate market landscape.

Analysing market drivers like population growth, infrastructure developments, and government policies helps identify key factors influencing property values and demand.

Understanding market trends through data on sales volumes, pricing fluctuations, and inventory levels allows for a detailed assessment of current market conditions.

Assessing challenges such as regulatory changes, competition, and market saturation, along with identifying potential opportunities like emerging markets or investment prospects.

Evaluating risk factors such as interest rate fluctuations, economic downturns, and natural disasters provides insights into potential risks that could impact real estate market stability and profitability.

- The first step in performing a Real Estate Market Analysis is to gather relevant data encompassing market sentiment, economic factors, market trends, drivers, challenges, opportunities, and risk assessments to provide a comprehensive foundation for analysis.

Analyse the Market Trends

Analysing market trends in Real Estate Market Analysis involves:

- Segmenting markets.

- Evaluating industry trends.

- Assessing market opportunities.

- Strategising investment approaches.

- Building property portfolios.

- Forecasting future market conditions.

This multifaceted process requires a keen eye for detail and a comprehensive understanding of real estate dynamics. By closely examining market segmentation, you can identify specific consumer groups with distinct preferences and needs. Understanding industry trends is crucial to stay ahead of the curve and adapt your investment strategies accordingly. Assessing market opportunities involves identifying emerging areas for growth and potential risks. Crafting a diverse property portfolio is essential for mitigating risks and maximising returns, while accurate market forecasts inform strategic decision-making for long-term success.

Conduct a Property Analysis

Conducting a property analysis in Real Estate Market Analysis involves identifying market patterns, assessing property trends, making predictions based on data interpretation, understanding property ownership dynamics, and generating comprehensive market reports for decision-making.

- The process begins by examining historical sales data, current market conditions, and demographic trends to identify patterns that can forecast future property performance.

- Predictive analysis techniques are then applied to anticipate potential price movements, demand shifts, and investment opportunities.

- Understanding the intricacies of property ownership, such as ownership transfer trends and landlord-tenant dynamics, is crucial for interpreting market predictions accurately.

- These insights are synthesised to create detailed reports that provide stakeholders with valuable information for strategic decision-making.

Consider the Local Economy

Considering the local economy in Real Estate Market Analysis involves:

- Analysing market fluctuations.

- Projecting future trends.

- Utilising market analysis tools.

- Understanding real estate market metrics.

- Identifying property listings.

- Segmenting target markets for effective decision-making.

This approach plays a crucial role in providing insights into the real estate market dynamics within a specific region. By delving into economic analysis, market researchers can gauge the local economy's health, which directly impacts property values and demand.

Trend projections offer valuable information regarding real estate assets' potential appreciation or depreciation. Market tools such as comparative market analysis help determine competitive pricing strategies and market positioning. Metrics such as absorption rate and days on market provide key indicators for property assessments and investment strategies.

What Are the Factors to Consider in Real Estate Market Analysis?

In Real Estate Market Analysis, several critical factors must be considered, including location, property type, market demand, competition, and economic conditions, to comprehensively understand market dynamics and make informed investment decisions.

Location plays a pivotal role as it directly influences property values and demand. Property type can drastically affect investment returns, with residential, commercial, or industrial properties exhibiting unique market behaviours.

Understanding demand patterns helps identify lucrative opportunities and tailor offerings to meet consumer needs. Analysing the competitive landscape sheds light on market saturation and pricing strategies.

Economic factors such as interest rates, inflation, and employment rates serve as crucial market drivers, presenting challenges and opportunities for investors.

Location

Location plays a pivotal role in Real Estate Market Analysis, influencing market sentiment, economic factors, property trends, market drivers, challenges, opportunities, and risk assessment to determine a property's desirability and value.

Investors, developers, and real estate professionals must conduct in-depth location analysis as it directly impacts market dynamics. By analysing factors such as proximity to amenities, transportation links, neighbourhood growth potential, and zoning regulations, they can gain insights into a property's attractiveness and future growth prospects. Location analysis also helps identify potential risks such as environmental hazards, market saturation, and fluctuations in demand, providing a comprehensive understanding of the investment landscape.

Property Type

The property type is a critical element in Real Estate Market Analysis, influencing market fluctuations, trend projections, analysis tools, market trends, metrics, property listings, and market segmentation to assess the viability and performance of different property categories.

Real estate professionals can gain valuable insights into consumer preferences, demand patterns, and market dynamics by conducting a detailed property type analysis. This analysis helps identify emerging trends, adjust listing strategies to target specific property types more effectively, and understand the segment-wise performance.

Analysts can make informed projections about future market behaviour and tailor their investment decisions by delving into market metrics like price per square foot, occupancy rates, and sales volumes across different property types.

Utilising sophisticated analysis tools such as regression models, GIS mapping, and data visualisation techniques further enhances the comprehensiveness of property type analysis in Real Estate Market Analysis.

Market Demand

Market demand analysis is a crucial aspect of real estate market analysis, involving identifying market patterns and property trends, predictive analysis, data interpretation, understanding property ownership dynamics, and generating detailed market reports to align supply with demand dynamics.

By conducting thorough market demand assessments, real estate professionals can gain valuable insights into consumer preferences, future trends, and potential risks or opportunities in the market. Understanding market demand allows informed decision-making, strategic planning, and effective property positioning to maximise returns.

Through pattern analysis and trend identification, stakeholders can anticipate shifts in demand, adapt marketing strategies, and tailor property offerings to meet evolving consumer needs. This data-driven approach enhances market prediction accuracy and helps create comprehensive market reports that provide a holistic view of the real estate landscape.

Competition

Assessing competition is a vital component of Real Estate Market Analysis, involving the evaluation of market segments, pattern analyses, trend assessments, predictive insights, data interpretation, ownership dynamics, and market reports to determine market positioning and competitive strategies.

By delving into competition analysis, real estate professionals can better understand the market landscape, identifying emerging property trends and projecting future ownership dynamics. Through meticulous scrutiny of market reports and performance metrics, informed decisions can be made regarding investment opportunities and competitive strategies. This comprehensive approach enables stakeholders to adapt to changing market conditions, tailor their offerings to meet consumer demands, and leverage predictive analysis to navigate the complexities of the real estate sector effectively.